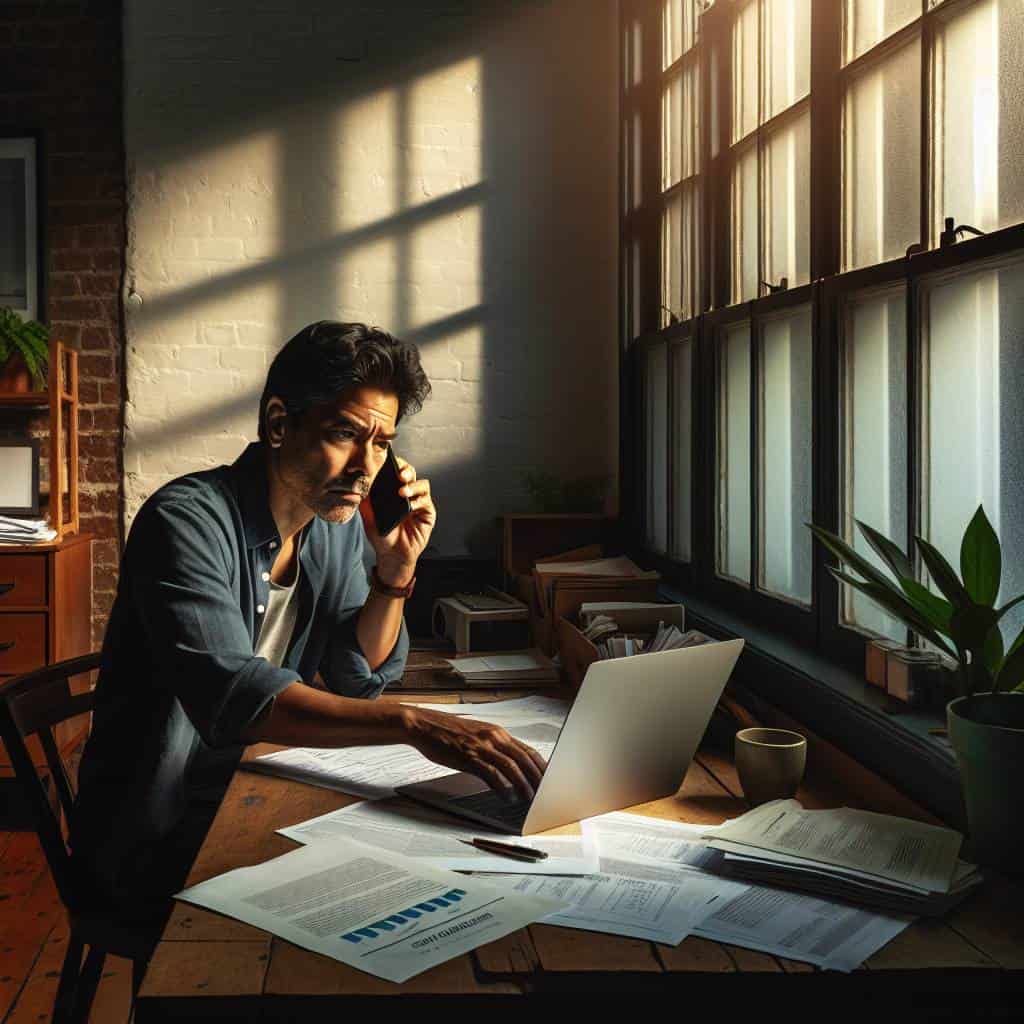

I remember the first time I stumbled into the messy labyrinth of the 1031 exchange. It was a cold morning in my cramped city apartment, where the only view was the brick wall of the neighboring building. My phone buzzed with a call from a client—voice dripping with desperation—asking if I could help him pull off a miracle. “I need to upgrade my rental without the IRS breathing down my neck,” he said. That’s when I realized that understanding a 1031 exchange isn’t about dodging taxes; it’s about navigating a legal maze where the walls keep shifting, and the exit seems intentionally elusive.

So, what’s the deal with 1031 exchanges, and why do they matter? I’m here to break it down for you. Expect a no-frills guide through the so-called ‘like-kind’ myth, the magic of tax deferral, and the investment rules that govern this financial dance. We’re not going to sugarcoat the complexities or pretend this is a walk in the park. But by the end, you’ll not only see why the taxman loves this loophole, but you’ll also feel like you finally have the map to navigate it, brick walls and all.

Table of Contents

The Tax Adventure: How Like-Kind Swaps Became My Unlikely Investment Hero

Picture this: I’m knee-deep in spreadsheets, battling the ever-present dread of tax season. My usual approach? Grim acceptance. But then, like a beacon of hope in the murky depths of the IRS’s labyrinth, I stumbled across the concept of like-kind exchanges. It’s the tax code’s version of a secret passageway—a 1031 exchange, in tax-speak. Suddenly, the drudgery of property swaps became an exhilarating game of chess, where I could strategically maneuver my real estate investments without the burdensome checkmate of capital gains taxes. The key to this game? Like-kind swaps. They’re not about trading apples for apples but more like trading Granny Smiths for Fujis and convincing the taxman it’s all the same fruit.

Here’s why these swaps are the unsung heroes of the investment world: they let you defer the tax bill. When you swap properties under the like-kind mantle, Uncle Sam holds off on collecting his dues. This means more cash stays in your pocket, ready for the next investment. It’s a strategy that lets you scale your portfolio without the tax-induced headaches. But don’t get too comfortable—there are rules to play by. The properties have to be business or investment assets, not your summer beach house. And there’s a ticking clock: you’ve got 180 days to close the deal. Miss the deadline, and the taxman comes calling. It’s a delicate dance, but when executed with precision, it’s a powerful move in the investor’s playbook.

So, how did like-kind swaps become my unlikely hero? By transforming the tax code from a fearsome adversary into a tactical ally. They taught me that understanding the rules isn’t just about compliance—it’s about mastering the game. In the world of real estate investment, a 1031 exchange is the secret handshake that opens doors. And while the road to tax freedom is paved with regulations and deadlines, once you navigate it, the rewards are undeniable. It’s a journey worth embarking on, especially when you’ve got a hero like the like-kind swap leading the charge.

Dissecting the Taxman’s Dance

A 1031 exchange isn’t just a tax deferral; it’s a game of chess with the IRS, where the pieces are your properties and ‘like-kind’ is the move that keeps you in the game.

The Realities of Dancing with the Taxman

Peeling back the layers on a 1031 exchange wasn’t just about understanding a tax deferral strategy; it was a deep dive into the psyche of our tax code—a labyrinth where ‘like-kind’ is the magic phrase that lets investors pirouette past immediate liabilities. This isn’t just a loophole; it’s a ballet of regulations and investments, where the nimble and informed get to keep their profits swirling in the market rather than lining the government’s coffers. It’s not about beating the system; it’s about mastering it.

As I reflect on this journey, I see the 1031 not as a mere tool, but as a testament to the power of knowledge. The rules are there, waiting to be leveraged by those with the guts to grasp them. But here’s the kicker—this isn’t for the faint-hearted or the complacent. It’s for those who, like me, are willing to strip away the layers, face the complexities head-on, and emerge not just smarter, but strategically armed. The taxman may have his rules, but understanding them is your first step to dancing in the financial spotlight.