I once thought I could outsmart the real estate market. Armed with spreadsheets, analytics, and an overinflated sense of my own genius, I dove headfirst into the so-called “cycles.” Everyone says buy low, sell high, but no one tells you that the market doesn’t care about your plans. It has its own agenda. Timing the market isn’t just a fool’s errand; it’s a full-blown circus act where you’re the juggler, desperately trying to keep all the balls in the air while dodging the occasional pie to the face. After a few bruises—and a deep dive into the murky waters of market analysis—I realized that cycles are less predictable patterns and more like mischievous phantoms that delight in making a mockery of the overconfident.

So, what’s the real story behind these elusive cycles? In this article, we’re not just going to scratch the surface. I’ll pull back the curtain on the myths and misconceptions about timing, the real indicators you need to pay attention to, and what happens when expansion inevitably gives way to recession. Forget the sanitized charts and textbook theories. We’re going to tackle the thrilling, sometimes terrifying rollercoaster of real estate with our eyes wide open. Buckle up, because it’s time to get honest about what really happens when you try to ride this unpredictable beast.

Table of Contents

Timing the Real Estate Roller Coaster: My Misadventures in Expansion and Recession

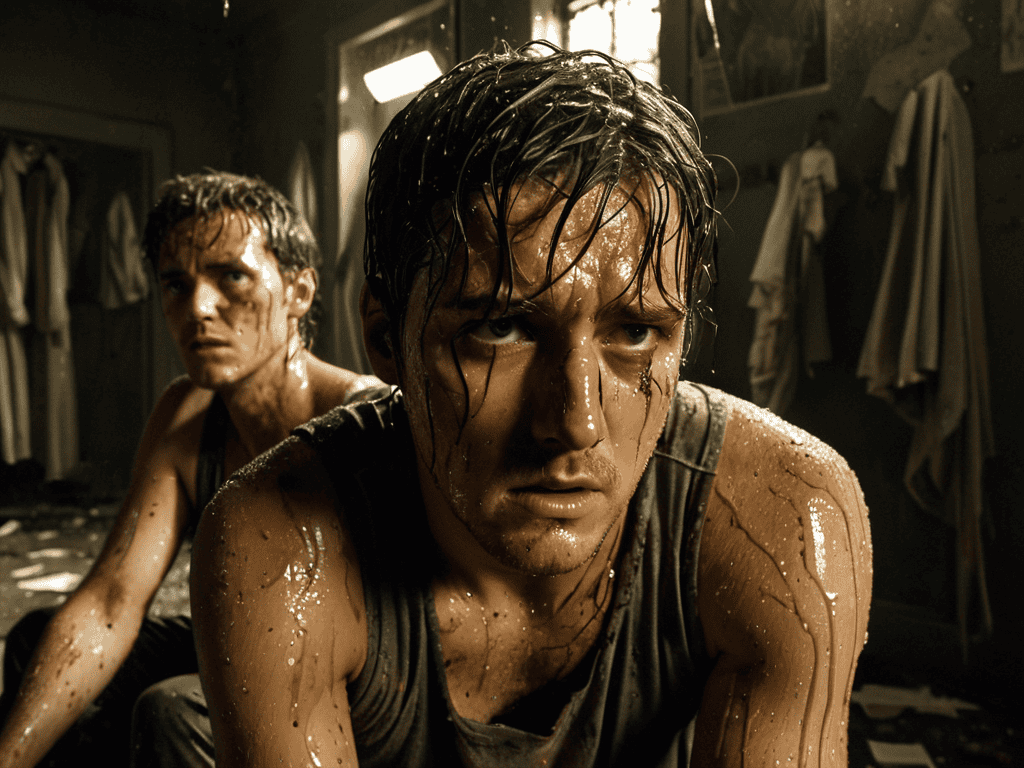

Riding the real estate roller coaster is like trying to dance in a minefield—one misstep and you’re toast. I’ve been there, clutching the safety bar with white knuckles as the market soared to dizzying heights, only to plummet into the depths of a recession. The thrill of expansion is intoxicating. Everyone’s a genius when the market’s hot, and I was no exception. I bought into the hype, watching property values skyrocket as if gravity had taken a holiday. But as any seasoned analyst knows, what goes up must come down. And when it does, it’s often with a gut-wrenching jolt.

Let’s talk timing. It’s the Holy Grail of real estate, right? Or so I thought, until I realized that timing the market is less about crystal balls and more about understanding the subtle indicators that whisper beneath the surface. Interest rates, employment numbers, consumer confidence—these are the puzzle pieces. Miss one, and your whole strategy can collapse like a house of cards. During a particularly brutal downturn, I learned this the hard way. Properties that were once golden tickets turned into lead weights dragging down my portfolio. It was a costly lesson in humility. But in the end, resilience is about learning, adapting, and knowing when to hold your nerve—and when to cut your losses.

The Unpredictable Dance of Property Markets

Real estate market cycles are like the tides—predictable in theory, yet full of surprises when you’re knee-deep in the water.

The Final Bell: Lessons from the Real Estate Arena

Reflecting on my ride through the ups and downs of real estate, I’m left with one undeniable truth: market cycles are ruthless teachers. They’ve taught me more about humility than any textbook ever could. Every expansion whispered promises of endless growth, only to be rudely interrupted by the siren call of recession. And yet, amidst the chaos, there lies a peculiar beauty in the patterns. Patterns that laugh in the face of those who claim mastery over them.

But here’s the kicker—those indicators, those elusive signals we chase like moths to a flame, they’re not the gospel. They’re just part of the messy, unpredictable dance. And whether you’re a seasoned investor or a wide-eyed newbie, the lesson is the same: embrace the uncertainty. Because in the end, it’s not about timing the market perfectly. It’s about having the guts to stay in the ring, knowing full well you might get knocked down, but always ready to get back up. That’s where the real wisdom lies.