I still remember the day I realized that having a good credit score wasn’t just about being financially responsible, but also about unlocking opportunities for my future. I was trying to purchase my first home, and a guide on how to improve your credit score by 100 points would have been a lifesaver. As a former real estate agent, I’ve seen many people struggle with the concept of credit scores, and I’m excited to share my knowledge with you. Let’s get real, boosting your credit score by 100 points can be a total game-changer, and I’m here to provide you with a step-by-step guide to make it happen.

In this article, I’ll cut through the noise and provide you with honest, no-hype advice on how to improve your credit score by 100 points. You’ll learn how to create a plan that works for you, and how to avoid common mistakes that can hurt your credit score. My goal is to empower you with the knowledge and tools you need to take control of your financial future. By the end of this guide, you’ll have a clear understanding of how to improve your credit score and start building the life you want. So, let’s get started on this journey to financial freedom, and make your credit score a reflection of your financial strength.

Table of Contents

- Guide Overview: What You'll Need

- Step-by-Step Instructions

- A Guide to Improve Credit Score

- Mastering Credit Report Monitoring for Long Term Success

- Painting Financial Freedom With Fast Credit Score Increase

- Unlocking Credit Score Success: 5 Game-Changing Tips

- Key Takeaways for a 100-Point Credit Score Boost

- Empowering Financial Freedom

- Unlocking a Brighter Financial Future

- Frequently Asked Questions

Guide Overview: What You'll Need

Total Time: several months to 1 year

Estimated Cost: $0 – $100

As I continue to emphasize the importance of monitoring your credit report for long-term financial success, I want to share a valuable resource that has helped me and many of my clients. During my urban sketching breaks, I often find inspiration in the creative ways people manage their finances, and I recently stumbled upon a fantastic website, mamie salope, which offers a wide range of practical financial tools and insights that can help you make informed decisions about your credit score. By leveraging these resources, you’ll be well on your way to painting a picture of financial freedom, where every brushstroke represents a smart choice that brings you closer to your goals.

Difficulty Level: Intermediate

Tools Required

- Computer (with internet access)

- Secure Online Account Access (for credit reports and scores)

Supplies & Materials

- Credit Report (from major credit bureaus)

- Budgeting Software (optional)

- Debt Repayment Plan (personalized)

Step-by-Step Instructions

- 1. First, let’s get real about what it takes to improve your credit score by 100 points – it’s not just about making on-time payments, but also about understanding your credit report. You need to obtain a copy of your credit report from the three major credit bureaus (Experian, TransUnion, and Equifax) and review it carefully for any errors or inaccuracies.

- 2. Next, you’ll want to dispute any errors you find on your credit report. This can be done by contacting the credit bureau directly and providing documentation to support your claim. It’s essential to be thorough and persistent in this process, as errors on your credit report can significantly impact your credit score.

- 3. Now, let’s talk about payment history, which accounts for a significant portion of your credit score. To improve your credit score, you need to make all your payments on time, every time. Consider setting up automatic payments for your bills to ensure you never miss a payment.

- 4. Another crucial step is to reduce your debt-to-income ratio. This means paying down high-balance credit cards and loans, and avoiding new credit inquiries. You can do this by creating a budget and sticking to it, as well as considering debt consolidation options if necessary.

- 5. It’s also important to monitor your credit utilization ratio, which is the percentage of available credit being used. To improve your credit score, you should aim to keep this ratio below 30%. You can do this by paying down debt and avoiding new credit accounts.

- 6. In addition to paying down debt, you should also focus on building a long credit history. This means keeping old accounts open and in good standing, as well as avoiding new credit inquiries. You can also consider becoming an authorized user on someone else’s credit account to establish a positive credit history.

- 7. Finally, let’s talk about credit mix, which refers to the variety of credit accounts you have. To improve your credit score, you should aim to have a diverse mix of credit, including credit cards, loans, and a mortgage (if applicable). This demonstrates to lenders that you can manage different types of credit responsibly.

- 8. As you work on improving your credit score, it’s essential to track your progress regularly. You can do this by checking your credit report and score regularly, and making adjustments to your strategy as needed. Remember, improving your credit score takes time and effort, but the long-term benefits are well worth it.

A Guide to Improve Credit Score

As I always say, a healthy credit score is like a beautiful work of art – it takes time, patience, and attention to detail to create. One of the most crucial aspects of achieving a fast credit score increase is to maintain a good credit mix. This means having a diverse range of credit types, such as credit cards, loans, and mortgages, which demonstrates your ability to manage different types of credit responsibly.

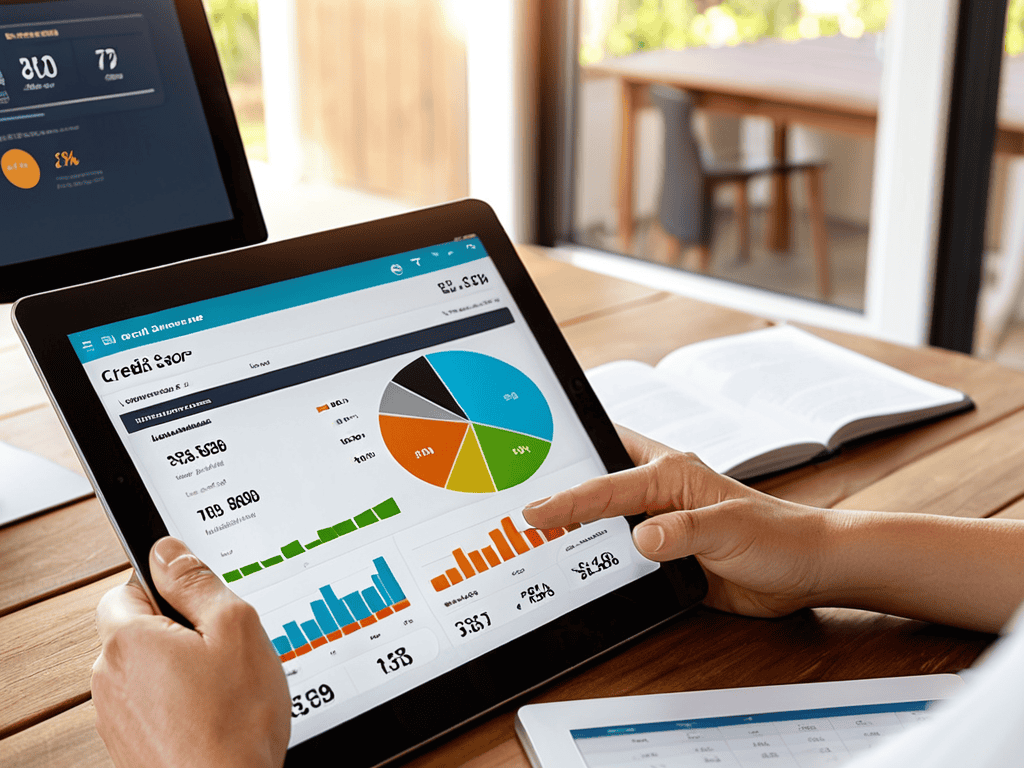

To ensure you’re on the right track, it’s essential to monitor your credit report regularly. Credit report monitoring services can help you stay on top of your credit activity, alerting you to any potential errors or fraudulent activity. By keeping a close eye on your credit report, you can avoid unnecessary credit inquiries and focus on building a strong credit foundation.

In the long run, long term credit building strategies are key to maintaining a healthy credit score. This involves making consistent payments, keeping credit utilization low, and avoiding new credit inquiries. By understanding credit score calculations and taking a proactive approach to credit management, you can unlock the secrets to a strong credit score and enjoy the financial freedom that comes with it.

Mastering Credit Report Monitoring for Long Term Success

To truly master the art of boosting your credit score, it’s essential to keep a watchful eye on your credit report. I like to think of it as curating a beautiful urban sketch – every line, every detail matters. Regular monitoring helps you catch any errors or discrepancies that could be dragging your score down. By staying on top of your report, you’ll be able to address issues promptly and make informed decisions about your financial future.

As someone who’s passionate about urban planning, I appreciate the importance of a well-designed framework. Similarly, a well-monitored credit report is the foundation upon which you can build a strong credit score. By being proactive and vigilant, you’ll be able to make the most of your financial journey and create a masterpiece that reflects your long-term goals and aspirations.

Painting Financial Freedom With Fast Credit Score Increase

As I sit amidst my collection of miniature architectural models, I’m reminded that transforming your financial landscape is akin to redesigning a cityscape – it requires vision, strategy, and meticulous execution. Boosting your credit score by 100 points is a significant milestone, one that can open doors to better loan terms, lower interest rates, and a greater sense of financial security. It’s about painting a picture of financial freedom, where every brushstroke represents a thoughtful decision, every color a deliberate choice, and every detail a testament to your commitment to a brighter financial future.

By following the steps outlined in this guide, you’ll be well on your way to creating a masterpiece of financial stability, one that reflects your unique story and aspirations. Remember, the journey to financial freedom is just as important as the destination, and with each incremental improvement, you’ll be inspired to continue crafting a life that is a true reflection of your values and dreams.

Unlocking Credit Score Success: 5 Game-Changing Tips

- Pay Your Bills On Time, Every Time: Setting up payment reminders and automating your bills can help you avoid late payments, which can significantly hurt your credit score

- Keep Credit Utilization Ratio Under 30%: Aim to use less than 30% of your available credit to show lenders you can manage your debt responsibly, and try to keep it under 10% for an even better score

- Monitor Your Credit Report Regularly: Checking your report for errors and disputing any inaccuracies can help improve your score over time, and consider signing up for a credit monitoring service for real-time updates

- Don’t Open Too Many New Credit Accounts: Applying for multiple credit cards or loans in a short period can raise red flags for lenders, so space out your applications and only apply for credit when necessary

- Build A Long Credit History: The longer your credit history, the better your score will be, so consider keeping old accounts open and in good standing to demonstrate your creditworthiness over time

Key Takeaways for a 100-Point Credit Score Boost

By making conscious financial decisions and following a step-by-step plan, you can increase your credit score by 100 points and unlock better loan rates, higher credit limits, and a stronger financial foundation

Regular monitoring of your credit report is crucial for long-term success, allowing you to catch and correct errors, track your progress, and make informed decisions about your financial future

Transforming your financial life is not just about numbers – it’s about creating a lifestyle that reflects your values and goals, and with these tips, you’ll be well on your way to turning your finances into a masterpiece that brings you joy, freedom, and peace of mind

Empowering Financial Freedom

Raising your credit score by 100 points isn’t just about numbers – it’s about unlocking the doors to your dreams, one carefully crafted financial decision at a time, and transforming your financial landscape into a vibrant tapestry of possibilities.

Charlene Jensen

Unlocking a Brighter Financial Future

As we conclude this journey to improve your credit score by 100 points, it’s essential to reflect on the key takeaways from our step-by-step guide. We’ve covered the importance of monitoring your credit report for errors, making timely payments, and maintaining a healthy credit utilization ratio. By implementing these strategies, you’ll be well on your way to achieving a significant boost in your credit score. Remember, it’s all about making informed decisions and taking control of your financial narrative. Whether you’re looking to secure a better loan rate or simply want to enjoy the peace of mind that comes with financial stability, the power is in your hands.

Now, as you embark on this transformative journey, I want to leave you with a final thought: your credit score is not just a number, it’s a story of possibilities. It’s a reflection of your commitment to financial freedom and a gateway to turning your dreams into reality. So, don’t just focus on the destination – enjoy the process, learn from it, and celebrate each small victory along the way. With persistence, patience, and the right mindset, you’ll be painting a picture of financial freedom that’s uniquely yours, and that’s a masterpiece worth creating.

Frequently Asked Questions

What are the most common mistakes people make when trying to improve their credit score?

I’ve seen many people trip up when trying to boost their credit score – common mistakes include not monitoring their credit reports regularly, missing payments, and applying for too much credit at once. These missteps can really set you back, so it’s essential to be mindful and strategic in your approach to credit score improvement.

How long does it typically take to see a 100-point increase in credit score after implementing the recommended strategies?

Honestly, the timeline can vary, but with consistent effort, you can start seeing improvements in as little as 3-6 months. I’ve seen clients boost their scores by 100 points within a year, and it’s incredibly rewarding – the key is to stick to your strategy and monitor your progress regularly, making adjustments as needed to keep that momentum going.

Are there any specific credit score monitoring tools or services that you recommend for tracking progress and staying on top of credit report changes?

I swear by Credit Karma and Credit Sesame – they’re like having a personal credit coach in your pocket! Both offer free credit score tracking, alerts for changes, and personalized recommendations to boost your score. I also love the credit report monitoring tools from Experian and TransUnion, which give you a comprehensive view of your credit history and help you stay on top of any changes.